south dakota property tax rate

And application of tourism tax. This surpasses both the national average of 107 and the average in North Dakota which is 099.

South Dakota Sales Tax Small Business Guide Truic

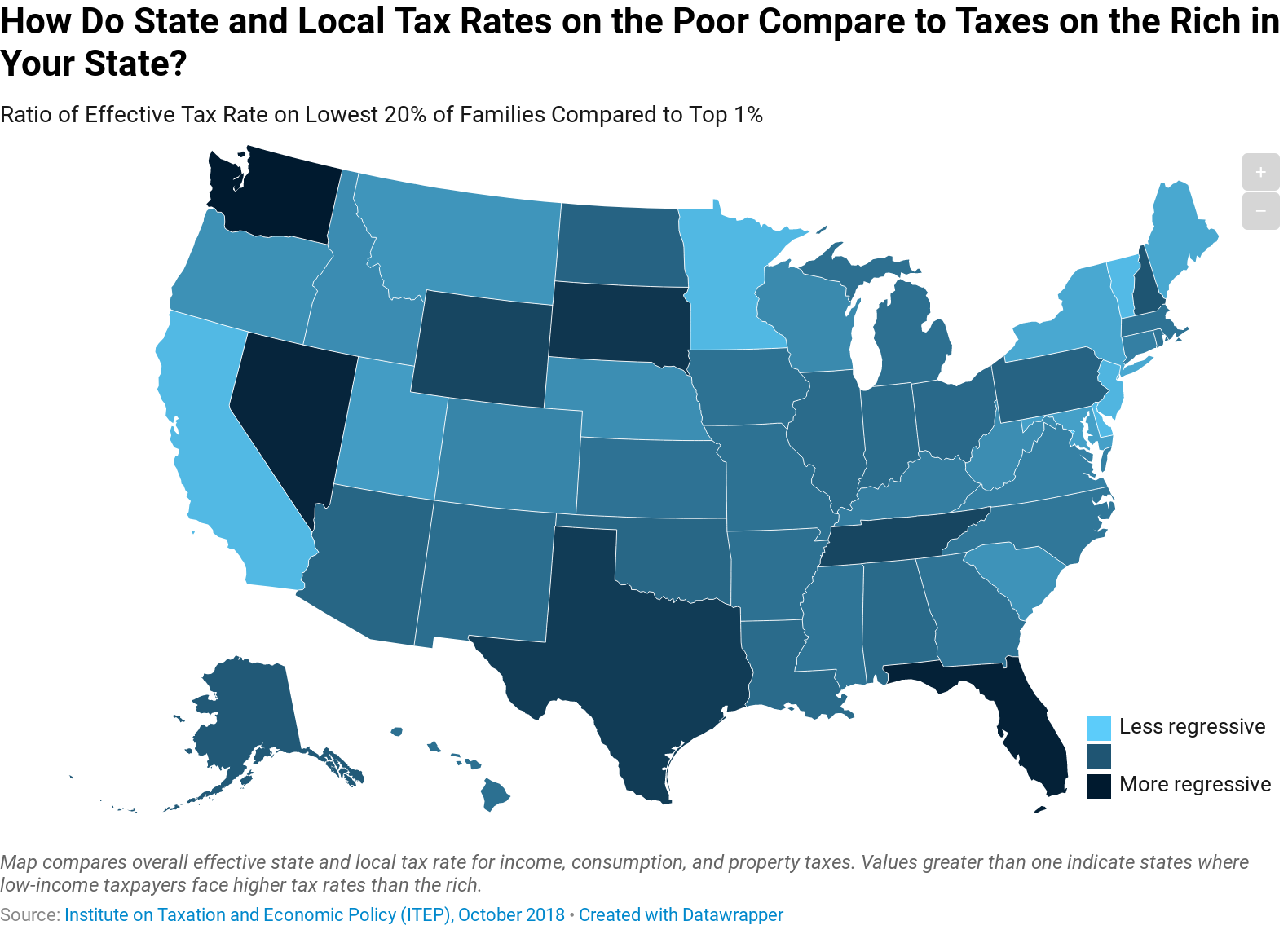

As Percentage Of Income.

. Local real property taxes in South Dakota vary from one to three percent of the market value of the structure with most rates falling around two percent. Homeowners living in a primary residence in South Dakota are eligible for a tax rate reduction. If you own a home in South Dakota you can expect to pay around 122 of your homes value in annual property taxes.

Across South Dakota the average effective property tax rate is 122. South Dakota Property Tax Rate. The first half of your real estate taxes are due by midnight on April 30 th.

This surpasses both the national average of 107 and the average in North Dakota which is 099. What is the South Dakota Homestead Exemption Program. Real estate taxes are paid one year in arrears.

The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128. The first step towards understanding South Dakotas tax code is knowing the basics. Searching for a sales tax rates based on zip codes alone will not work.

The list is sorted by median property tax in dollars by default. You can look up your recent appraisal by filling out the form below. The South Dakota Department of Revenue has issued a municipal tax guide that provides an introduction to municipal sales use and gross receipts taxes.

The property tax is an ad valorem tax on all property that has been deemed taxable by the South Dakota Legislature. How does South Dakota rank. Then the property is equalized to 85 for property tax purposes.

Convenience fees 235 and will appear on your credit card statement as a separate charge. Click Search for Tax Rate Note. A financial advisor in South Dakota can help you understand how taxes fit into your overall financial goals.

As of 2005 South Dakota has the lowest per capita total state tax rate in the United States. Then the property is equalized to 85 for property tax purposes. Overview of South Dakota Taxes Across South Dakota the average effective property tax rate is 122.

31 rows The state sales tax rate in South Dakota is 4500. Median property tax is 162000. If the county is at 100 of full and true value then the equalization factor the number to get to.

For instance if your home has a full and true value of 250000 the taxable value will add up to 250000 multiplied by 085 212500. What is the Property Tax. Below we have highlighted a number of tax rates ranks and measures detailing South Dakotas income tax business tax sales tax and property tax systems.

The publication also discusses the tax applicable to special devices. Commercial properties meanwhile have seen. For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying.

In South Dakota tax collectors sell tax lien certificates to the winning bidders at the delinquent property tax sales. Calculate how much youll pay in property taxes on your home given your location and assessed home value. If you have a home in South Dakota you can pay less than 15 percent of your property value in yearly taxes.

However five-year property tax abatements are available on new structures or additions to existing ones. Across the state the average effective property tax rate is 122. Click the tabs below to explore.

South Dakota Enter your financial details to calculate your taxes Average County Tax Rate 1330 Union County Property Taxes. Not in South Dakota. By reason of this en masse approach its not only probable but also certain that some market worth evaluations are inaccurate.

Compare your rate to the South Dakota and US. On the plus side several programs help senior citizens with high property tax bills. If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard.

The winning bidder is the one willing to pay the most for the tax lien. The property tax is the primary source of revenue for local governments. In the year 2020 property owners will be paying 2019 real estate taxes Real estate tax notices are mailed to the property owners in either late December or early January.

The only major tax in South Dakota that stands above the national average is its property tax which is 122 compared to the 107 national mark. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85. If your taxes are delinquent you will not be able to pay online.

Please call the Treasurers Office at 605 367-4211. Ad valorem refers to a tax imposed on the value of something as opposed to quantity or some other measure. In real dollars the states farmers and ranchers saw their collective property tax bill rise from 2197 million in 2008 to about 3546 million in 2017.

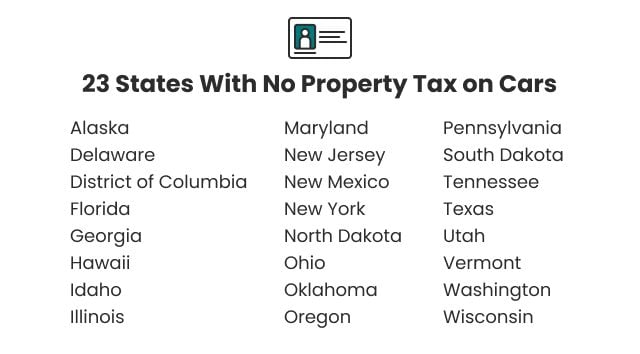

You can sort by any column available by clicking the arrows in the header row. Dictated by South Dakota law this operation is supposed to allocate the tax burden in an even way statewide with equitable property tax rates. The state does not levy personal or corporate income taxes 135 inheritance taxes 136 or taxes on intangible personal property.

This interactive table ranks South Dakotas counties by median property tax in dollars percentage of home value and percentage of median income. The taxing authorities then apply an 85 equalization ratio to get the propertys taxable value. This is the value upon which your South Dakota property taxes are based.

A home with a full and true value of 230000 has a taxable value 230000 multiplied by 85 of 195500. Sales Tax Rates by Address. Depending on where the property is located the homeowner has approximately three 3 or four 4 years from the date the tax lien certificate was.

There are however some programs to help seniors with high property tax bills in South Dakota. South Dakota has no state income tax.

Dakota County Mn Property Tax Calculator Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Taxes How Much Are They In Different States Across The Us

States With Highest And Lowest Sales Tax Rates

South Dakota Property Tax Calculator Smartasset

Property Tax South Dakota Department Of Revenue

Property Tax Definition Learn About Property Taxes Taxedu

Property Tax South Dakota Department Of Revenue

Property Tax South Dakota Department Of Revenue

Thinking About Moving These States Have The Lowest Property Taxes

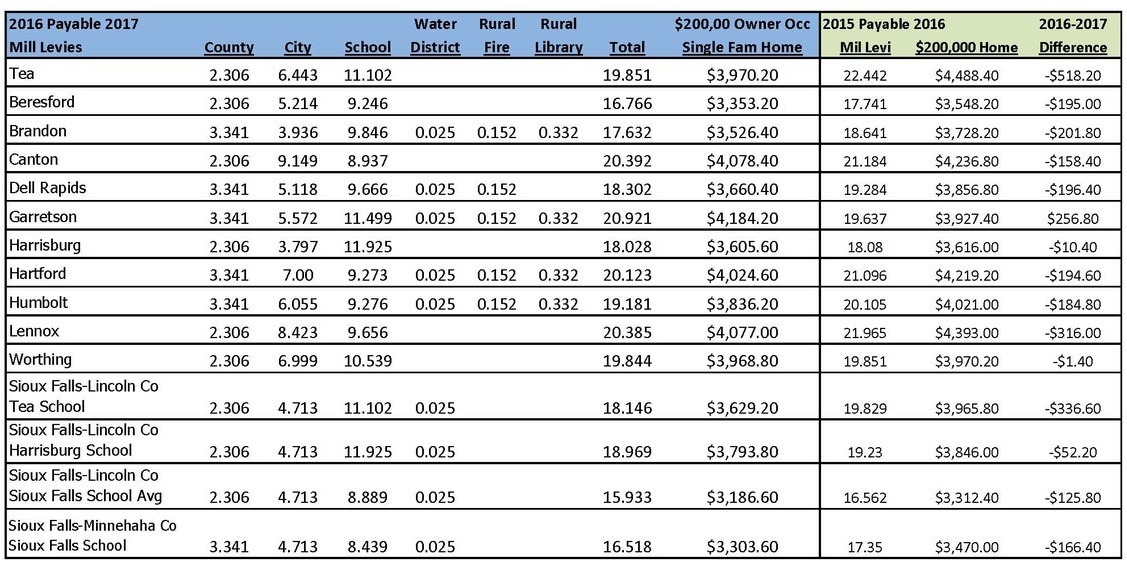

Tax Information In Tea South Dakota City Of Tea

Property Taxes Calculating State Differences How To Pay

The Most And Least Tax Friendly Us States

South Dakota Property Tax Calculator Smartasset

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)