fit on paycheck stub

Paycheck Stub Abbreviations for Earnings. Social Security or Social Security Tax Withheld.

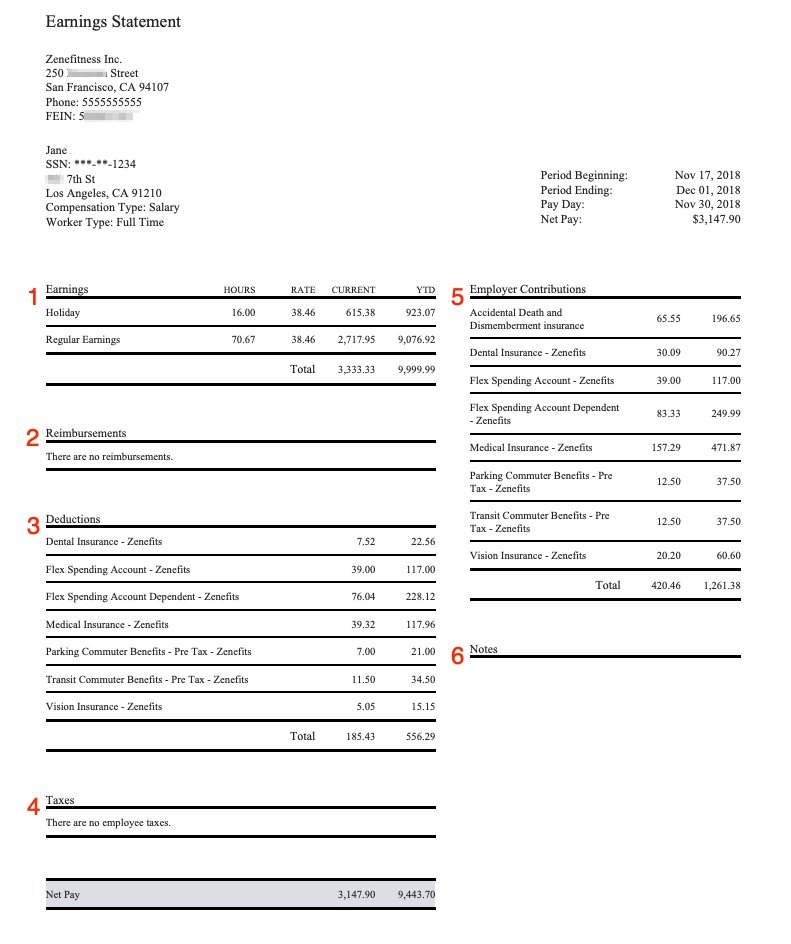

What Does A Pay Stub Look Like Workest

FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

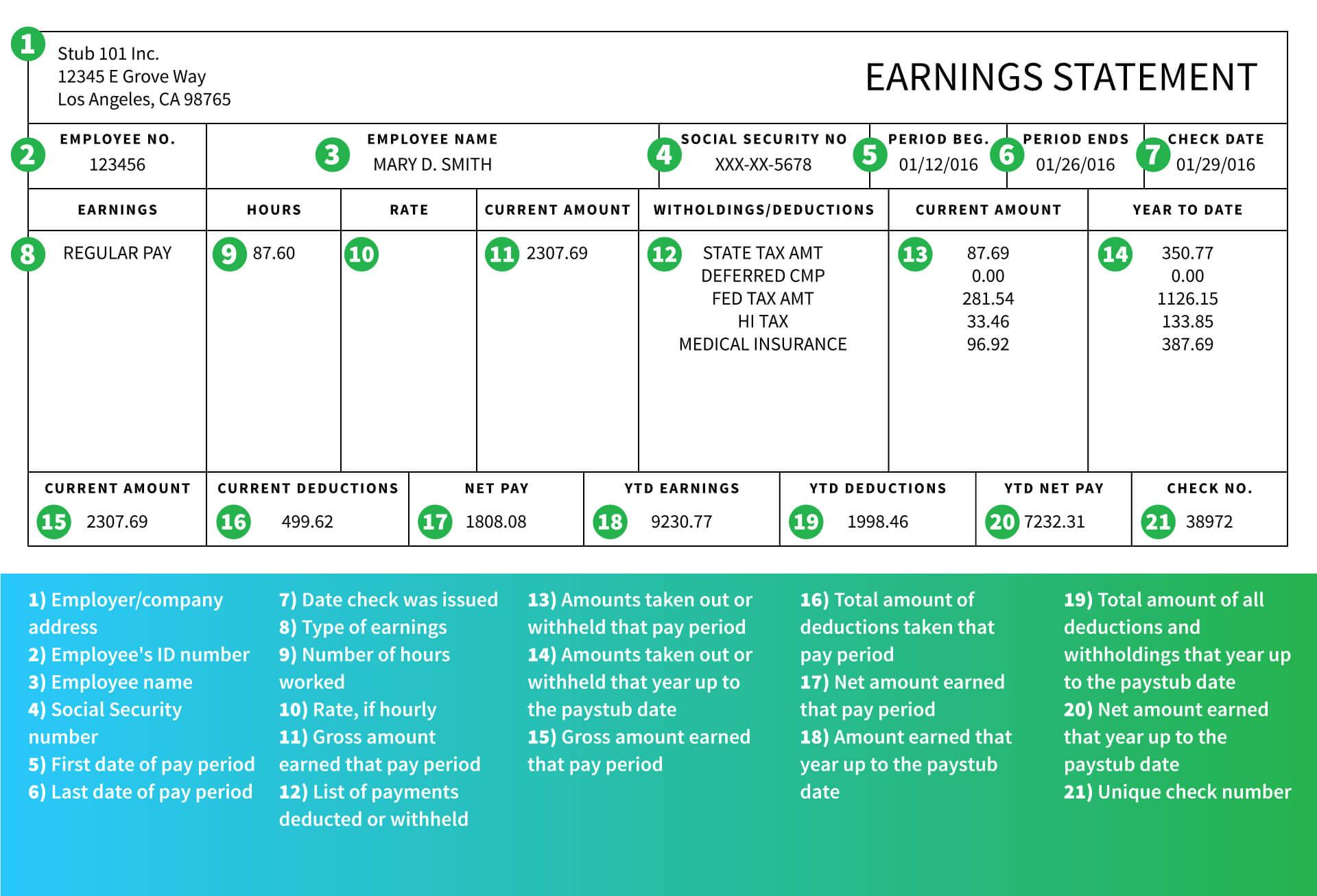

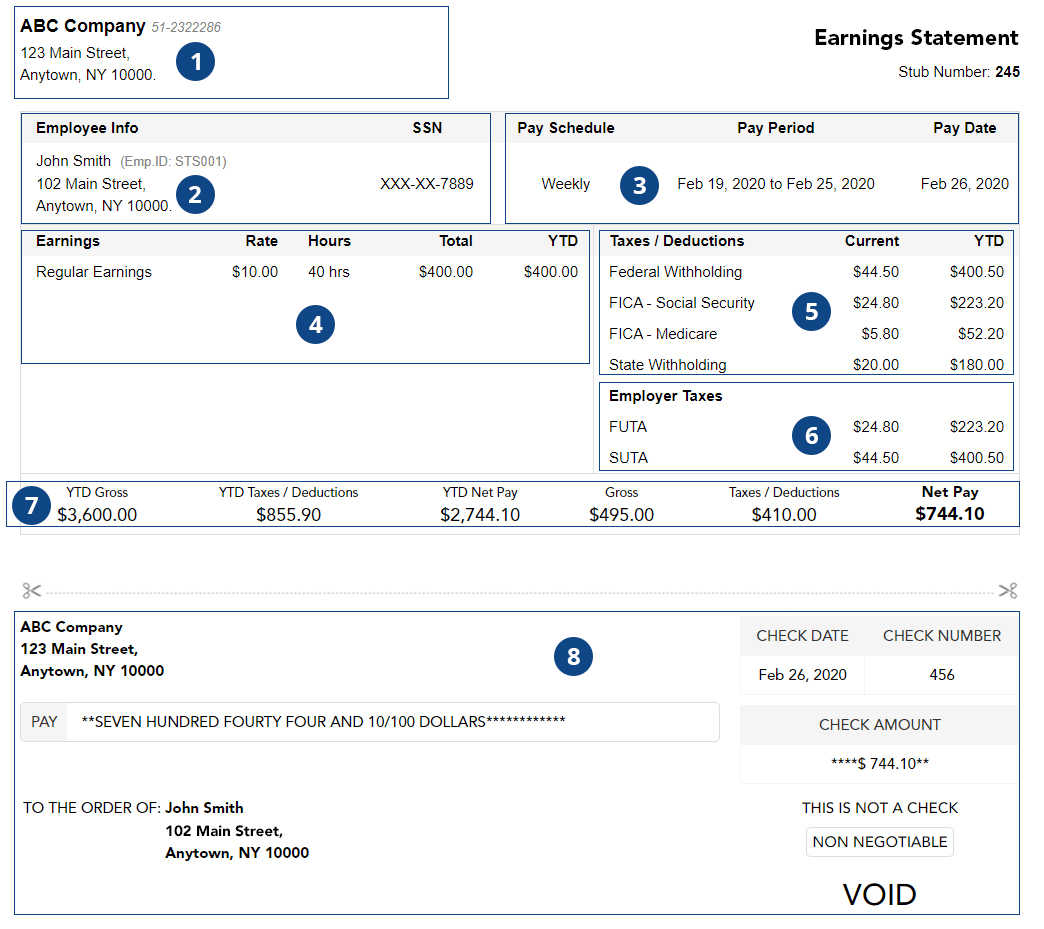

. The paycheck stub header is where youll find your name and address pay period the address of your company or employer and your Social Security number. Every individual is required to pay federal income taxes on their taxable earnings that can include wages salaries bonuses tips or others. The pay stub contains a lot of details about the salary received.

In a nutshell you see FIT tax on your paycheck as your employer is required to withhold a certain amount of money as federal income tax FIT from your earnings. Withholding is one way of paying income taxes to the. A paycheck stub summarizes how your total earnings were distributed.

The Employees social security number. Evaluating Your Earnings Statement. FIT is applied to taxpayers for all of their taxable income during the year.

Your net income gets calculated by removing all the deductions. A good number of employees rarely understand why the money earned is not always 100 of the amount that an employer promises. This is the amount of money earned during the pay period.

What Is the FIT Deduction on My Paycheck. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes. Your earnings statement indicates your gross pay which is the total amount of money earned for.

FIT Fed Income Tax SIT State Income Tax. Ariel SkelleyBlend ImagesGetty Images. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may exist for that employee. They are not meeting the taxable wage base. Your pay stub will also show how much youve earned during the year so far and for that pay period.

The information on a paystub includes how much was paid on your behalf in taxes how much was deducted for benefits and the total amount that was paid to you after taxes and deductions were taken. 1 medicare and 2 social. It covers two types of costs when you get to a retirement age.

Your pay stub will also show how much youve earned during the year so far and for that pay period. Here is a list of the abbreviations youll usually find in the header of your paycheck stubs. The employees W-4 form and.

To this effect employers are asked to withhold a. Similarly it is asked what is fit on my paystub. Fit is applied to taxpayers for all of their taxable income during the year.

These are any amount of money thats taken from your paycheck before you get it. These items go on your income tax return as payments against your income tax liability. Estimated net pay 1852 Your actual withholding might different depending on many.

FIT on a pay stub stands for federal income tax. SSN Social Security number. FIT is applied to taxpayers for all of their taxable income during the year.

While the task of figuring out FIT withholdings for your employees may seem tricky with the help of Block Advisors payroll service or payroll software like Wave your payroll to-dos just got easier. Common Abbreviations Used on Paycheck Stubs. The rate is not the same for every taxpayer.

Some of the details. The name of the Employee. An employees pay stub is simply a part of the paycheck.

On a pay stub this tax is abbreviated SIT which stands for state income tax. Fit stands for Federal Income Tax Withheld. To calculate Federal Income Tax withholding you will need.

For example if they are married paid twice a month and their gross for one. Make sure you have the table for the correct year. FIT is withheld from an employees paycheck based on the amount of their federal taxable wages.

Paycheck stubs are normally divided into 4 sections. They go toward costs needed to run the federal government. The dates for the pay period should also appear somewhere on the stub.

A good indicator of why income tax was not withheld from the employees paycheck is to review their gross pay and tax status. FIT means federal income taxes. State Tax or State Tax Withheld.

Employees generally receive a paycheck along with additional information an. FICA means Federal Insurance Contribution Act. Answer 1 of 2.

The employees adjusted gross pay for the pay period. This is simply because they do not take time to examine their pay stub. General Pay Stub Abbreviations.

FIT stands for federal income tax. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. A company specific employee identification number.

Federal Tax or Federal Tax Withheld. A copy of the tax tables from the IRS in Publication 15. Here are some of the general pay stub abbreviations that you will run into on any pay stub.

Calculate Federal Income Tax FIT Withholding Amount. With 65000year salary - your bi-weekly Gross Pay should be 2500 Federal Withholding 385 Social Security 105 Medicare 36 Connecticut state income tax withholding 122 - seems as your actual deduction is much higher - that is a question to your payroll person. TDI probably is some sort of state-level disability insurance payment eg.

Some are income tax withholding. If a paycheck shows 000 or no income tax withheld it may be caused by any of the following. Personal and Check Information.

Fit stands for federal income tax withheld. The last part of your paystub is where youll find the deductions. In the United States federal income tax is determined by the Internal Revenue Service.

Gross Pay and Net Pay.

A Guide On How To Read Your Pay Stub Accupay Systems

Free Packing Pay Stub Template Excel Word Apple Numbers Apple Pages Pdf Template Net Powerpoint Word Word Doc Templates

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Different Types Of Payroll Deductions Gusto

Understanding Your Paycheck Credit Com

Fillable Form Pay Stub Budget Forms Paying Paycheck

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Pay Stub Copy Generator Pdfsimpli

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Form Payroll Template Sample Resume Resume Template Free

Decoding Your Pay Stub Infographic Money Management Decoding Understanding Yourself

The Ultimate Check Stub Template Monday Com Blog

How To Read A Pay Stub Gobankingrates

Pin On Beautiful Professional Template

What Everything On Your Pay Stub Means Money

Understanding Pay Stub Understanding Paycheck Stub

Organisation Pay Stub Template Word Apple Pages Pdf Template Net Payroll Template Templates Free Organization

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp